EmaraTax represents a significant leap in the United Arab Emirates’ journey to modernise its tax system and streamline processes for taxpayers. This comprehensive guide delves into the intricate workings of EmaraTax, from its relevance in the UAE’s fiscal landscape to its user-friendly features that facilitate tax compliance and administration. Whether you are a new registrant or a seasoned tax filer, this article will serve as your essential roadmap to navigating the EmaraTax portal, understanding its various services, and ensuring that you fulfil your tax obligations effectively and securely.

With particular emphasis on the legal framework, account security, and support mechanisms, this guide aims to equip you with all the necessary tools and knowledge to manage your tax affairs confidently and easily in the UAE.

EmaraTax and its Relevance

Overview of EmaraTax

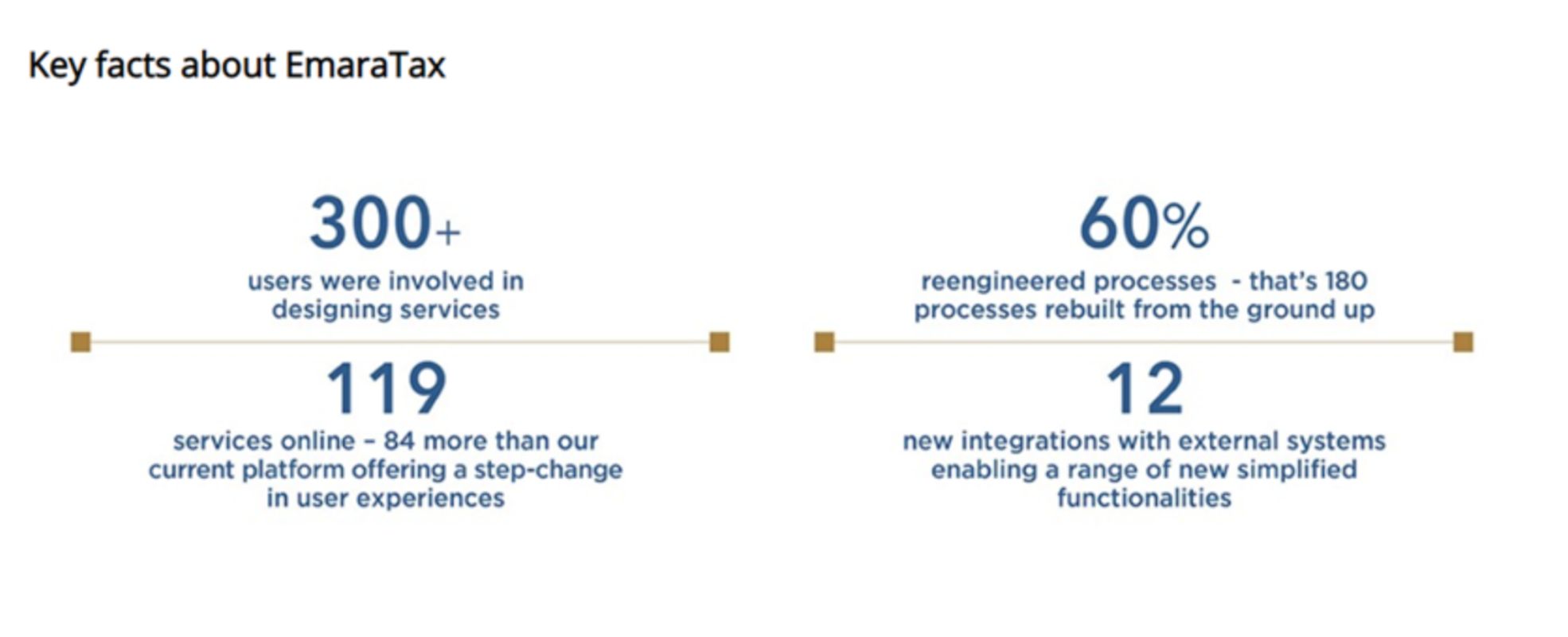

EmaraTax is a major step forward in the UAE’s push to modernise its tax system. You can access this digital platform through the Federal Tax Authority’s (FTA) official website. It acts as a centralised hub to simplify managing tax obligations for taxpayers in the UAE. It’s user-friendly and, integrates with key government entities, such as the UAE Central Bank, and fits in with national tech-based programs like UAE PASS.

The platform’s intuitive design makes it easy to navigate and enhances your experience with improved self-help options. A mobile version is on the horizon, which will make it even more accessible. You can log in using your Emirates ID, UAE Pass, or the traditional username and password.

Once you’re in, you’ll be able to easily update your bank account details, get timely reminders to renew documents, and see detailed information about your tax affairs, like outstanding payments, penalties, and tax types for specific periods.

Importance of EmaraTax in the UAE

With the launch of EmaraTax, the UAE, a country diversifying its economy with a growing share of non-oil revenues, has enhanced its tax administration capabilities. This system makes decision-making more efficient and offers early support to taxpayers who need it.

It also provides a transparent and efficient communication channel with the FTA. You can track your entire activity history, manage filed applications, and review all correspondence in one place.

In the UAE’s tax landscape, there’s a corporate income tax (CIT) rate of 9%, with returns due within nine months from the end of the tax period. There’s no personal income tax, and the standard VAT rate is 5%.

EmaraTax supports these structures by offering services like VAT and Excise return filings, VAT refund applications, and the ability to download and upload necessary documents and templates to ensure accuracy and compliance.

Legal Framework Governing EmaraTax

The legal framework for EmaraTax is part of the UAE’s wider legislative environment, which includes a stable political system and one of the most liberal trade regimes in the Gulf region. The UAE is a constitutional federation of seven Emirates, with Arabic as the official language and English commonly used in business.

The dirham (AED) is the UAE’s official currency. The country’s tax laws are evolving, with the CT law applicable for financial years starting on or after June 1, 2023. The law took effect 15 days after its publication in the official gazette.

The law clarifies key provisions and is supported by cabinet and ministerial decisions and guidance from the tax authority. This legal backdrop highlights the role of EmaraTax in ensuring compliance and facilitating the smooth operation of the tax system.

The platform also supports the submission of various requests, such as tax clarifications, reconsiderations, and complaints. It offers services like tax certificate issuance and VAT registration. It’s important to note that the FTA’s services are exclusively accessible through Digital Identity registration, underscoring the importance of security and identity verification in the digital tax environment.

Navigating the EmaraTax Portal

Registration Process for New Users

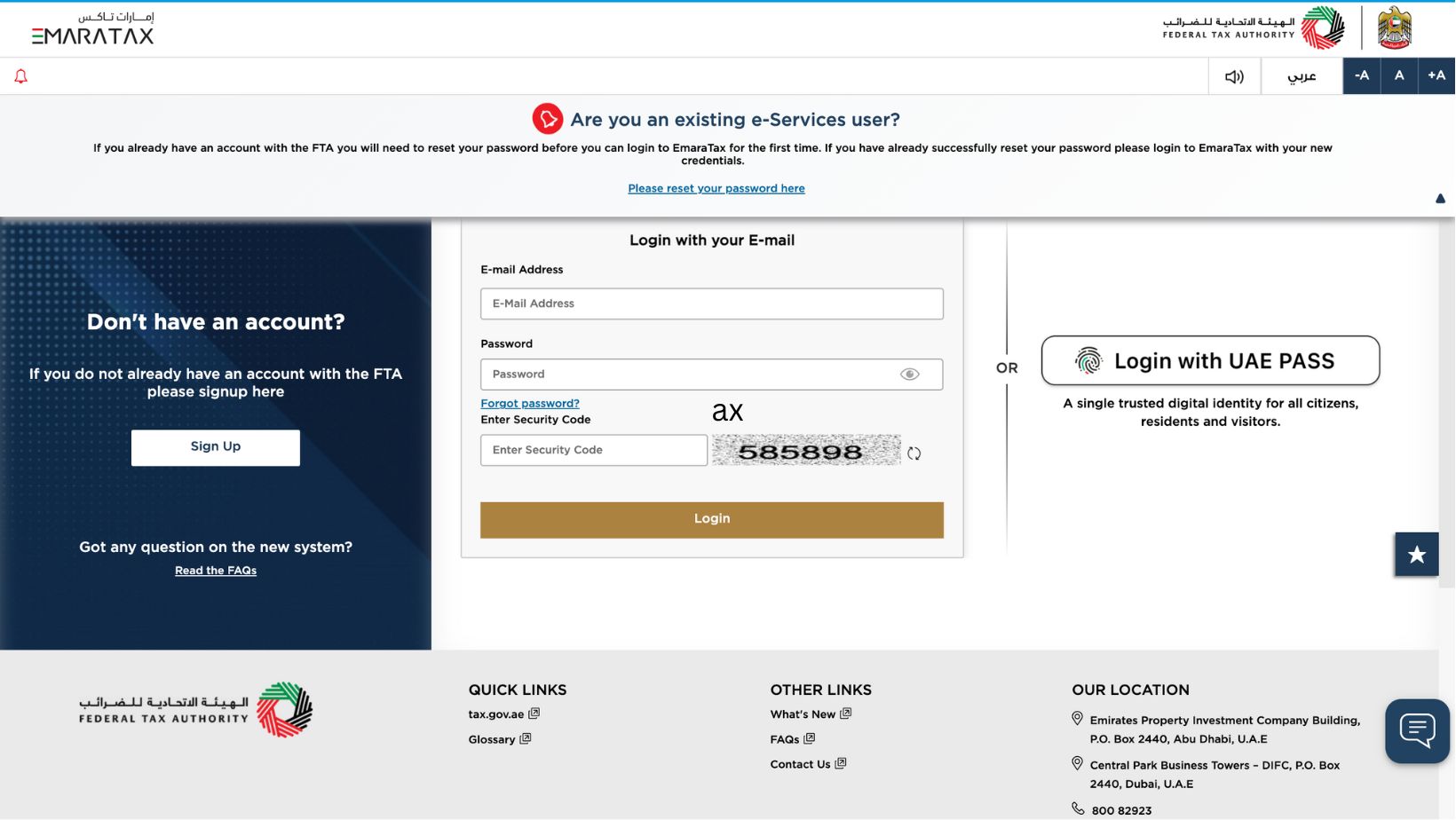

For those who are new to the system, registration is a straightforward process designed to avoid redundant applications by verifying Emirates IDs for uniqueness. After completing registration, you can sign in using various methods, including your Emirates ID, UAE Pass, or User ID and Password.

For first-time access, if your details from an existing FTA account have been transferred over, you will be prompted to create a new password to enhance security. The updated registration form now requires additional mandatory information to ensure comprehensive data collection from the outset.

Dashboard Features and Accessibility

The portal’s user interface is designed for efficiency, allowing you to fulfil your tax responsibilities easily. You can update banking information from the dashboard, view detailed descriptions of outstanding payments and penalties, and handle communications with the FTA.

Notifications to renew critical documents will be sent before their expiration. The dashboard enables you to handle correspondence, certificates, NOC requests, and audit interactions. For additional support, the portal provides improved self-help resources. It will be available on mobile platforms shortly, increasing its convenience.

Submitting Tax Returns via EmaraTax

The portal streamlines the process of filing tax returns. Since December 5 2022, all VAT and Excise Tax returns must be completed and lodged through EmaraTax. A downloadable VAT return template is available to facilitate offline preparation, which can be uploaded to the portal for verification before finalising the submission.

VAT payments can be made via MagnatiPay, a new payment gateway that accepts various cards. Each payment has a unique 6-digit reference number essential for processing through financial institutions and exchange services. The system allows for the allocation of payments towards specific liabilities or penalties, with the option for partial settlements.

For VAT refunds, the redesigned layout simplifies the application and processing steps. Refunds can be requested for each tax period, and the necessary documentation, such as invoices and proof, can be submitted through the online application.

Advance payments can be allocated towards future VAT liabilities or to cover existing ones. The ‘My payments’ section provides a comprehensive view of the payment status for each return and enables management of financial transactions, including the ability to cancel them.

Key Features of EmaraTax Services

The platform’s integration with the UAE Central Bank and UAE PASS is part of the country’s broader digital agenda, aiming to leverage emerging technologies and establish a robust digital infrastructure to benefit individuals and the business community.

The system provides improved self-help options, ensuring you can find assistance when needed. With plans to extend its accessibility to mobile devices, EmaraTax is set to become even more convenient for users. The platform’s enhanced capabilities allow the FTA to engage more proactively with taxpayers, facilitating better and faster decision-making. You’re encouraged to continue submitting your tax returns and making payments as usual, with the assurance that any significant updates will be communicated through the EmaraTax microsite, social media channels, or email.

Tax Refund Procedures and Guidelines

EmaraTax has streamlined the tax refund process, making it faster and more secure. You can now submit a consolidated refund request for all eligible credit balances across multiple tax periods for each type. This simplification is a boon for VAT or Excise Tax registered entities. The system automatically validates UAE beneficiary account details before processing refunds, ensuring the security and speed of transactions. Supporting evidence for refund requests can be submitted online, enhancing the process for various entities, including home builders, accredited foreign missions, diplomats, mosque constructors or operators, and business visitors. The platform’s online capabilities allow for easy submission and tracking of refund applications, with significant enhancements tailored to assist taxpayers.

Managing Tax Records and Payments

EmaraTax has brought about substantial improvements in how tax payments are made. A unique payment reference number for GIBAN payments has been introduced. UAE banks and other financial institutions are now integrated with the system. This integration ensures that when making a GIBAN payment, the unique reference number is used to validate the GIBAN and the amount payable.

Additionally, MagnatiPay serves as the new payment gateway for EmaraTax, accepting Visa or Mastercard prepaid, debit, or credit cards. A comprehensive payments guide is available for download, providing an overview of the new payment processes.

For businesses engaged in e-commerce, specific guidance on reporting these supplies through VAT returns on EmaraTax is available. The transition to EmaraTax has been made smoother by automatically transferring existing FTA account details to the new system, with users only needing to reset their passwords upon first use.

Compliance and Penalties for Non-Compliance

The UAE’s corporate tax law requires that businesses maintain specific accounting records and, if necessary, seek professional assistance for compliant bookkeeping. The corporate tax rates are tiered based on annual net profits. While free zone businesses enjoy certain exemptions, they must meet specific criteria to benefit from them. Businesses with revenue below a certain threshold per tax period may qualify for exemption from corporate income tax. It’s important for VAT-registered businesses to also register for income tax.

Non-compliance with corporate tax regulations can result in administrative penalties ranging from USD 136 to USD 5446 (AED 500 to AED 20,000), effective since August 2023. To help the business community understand these implications, the FTA has launched an extensive awareness campaign, including virtual workshops on ‘Corporate Tax Registration’. These workshops cover the creation of a new user profile on the EmaraTax portal, necessary documentation, application procedures, and obtaining a UAE Corporate Tax Registration Number.

Tax evasion is a serious crime in the UAE, with penalties including imprisonment and monetary fines that can reach up to five times the amount of evaded tax. The average jail sentence for tax evasion is seven years, with the possibility of higher penalties for more severe cases involving money laundering or tax fraud. The FTA detects tax evasion through various actions, such as the non-issuance of invoices, claiming false input tax credits, wrongful availment of exemptions, and falsification of exports. The FTA has made it clear that strict penalties await those who engage in such illicit activities.

Securing Your EmaraTax Account

Best Practices for Account Security

Upon initial access to EmaraTax, you will be prompted to create a new password. This measure is crucial for safeguarding your account. It is advisable to devise a robust and distinct password from those utilised on other websites.

To reset your password, visit the EmaraTax portal and adhere to the instructions provided for existing users.

Incorporating UAE Pass into your login routine can further fortify your account against unauthorised access, streamlining the authentication process while enhancing security.

Common Security Pitfalls and How to Avoid Them

A prevalent error is the use of simplistic passwords or identical ones across multiple platforms. To circumvent this, ensure that your EmaraTax password is intricate and exclusive. Additionally, remain vigilant for phishing attempts and fraudulent communications masquerading as the FTA or EmaraTax.

Verify the authenticity of any requests for personal information. Under no circumstances should you divulge your credentials.

If you encounter issues accessing your registered email, EmaraTax provides an alternative for password recovery. You have the option to update your email address within the system, which is crucial for maintaining uninterrupted access to your account.

What to Do in Case of a Security Breach

In the event of a security incident, promptly modify your password. If you suspect unauthorised access to your account, contact the FTA’s support team without delay.

They will assist in securing your account and investigate the incident.

For inquiries, consult the FAQ section on the EmaraTax microsite. If your concern still needs to be addressed there, the FTA encourages submitting your question, and they regularly update the FAQ to assist users with similar queries.

Support and Assistance in EmaraTax

Using the Help Center Effectively

The Help Center is a repository of resources, including a VAT Knowledge Base, user manuals, and a quick start guide, all aimed at helping you manage your tax obligations.

The platform offers daily orientation sessions and webinar recordings to help you get acquainted with the new features, including the enhanced payment process. Taking advantage of these resources is a good idea to avoid penalties due to late or incorrect payments.

Contacting EmaraTax Customer Service

When you run into issues or have specific questions, contacting EmaraTax Customer Service is straightforward. The FTA Call Center can be reached at 80082923; support is also available via email. The service operates 24/7 through the FTA’s website and email, with phone support available during official hours. You can visit the Taxpayer Support Centers in Abu Dhabi and Dubai for more direct assistance.

The FTA stresses the importance of protecting your personal information, reminding you never to share passwords or OTP codes with anyone, including FTA employees. A reference number provided after submission can be used if you need to follow up on applications. The estimated time for the FTA to address inquiries varies depending on the method of contact, with e-forms and emails typically resolved within two business days.

Resolving Disputes and Seeking Clarifications

You may occasionally need to resolve disputes or seek clarifications regarding tax matters. EmaraTax provides mechanisms for both, ensuring that you have avenues to address any concerns. If you need to dispute a decision made by the FTA, you can submit a reconsideration request as per Article (27) of the Tax Procedures Law. This process involves applying the necessary documents and data through the online objection systems.

For cases requiring escalation beyond a reconsideration request, you can file a case with the Tax Dispute Resolution Committee, including all supporting documentation and conducting the process in Arabic. It’s recommended to consult the relevant articles on tax procedures in Federal Law No. 7 of 2017 before proceeding.

The FTA offers a tax clarification service for matters that are less contentious but still require clarification. This service allows you to seek official clarification on uncertain tax matters after reviewing relevant laws and guidance. There is a fee associated with this service, and the FTA aims to respond within 50 business days from the receipt of a complete application. It’s important to note that clarifications are not considered decisions and are not subject to reconsideration by the FTA. They are intended solely for your use and should not be used for tax abuse purposes.

Embracing EmaraTax: Your Gateway to Efficient Tax Management

As the UAE continues its journey towards a more digitised economy, the EmaraTax platform stands out as a beacon of innovation in tax administration. Whether you’re a business owner, tax consultant, or individual taxpayer, embracing the functionalities of EmaraTax can streamline your processes, enhance compliance, and provide peace of mind, knowing you’re working within the framework of the UAE’s tax regulations.

By leveraging this state-of-the-art portal, you’re staying ahead of your tax obligations and contributing to the country’s ambitious digital future. As EmaraTax evolves, expect it to become even more integral to your tax management, offering tools as forward-thinking as the UAE’s vision. Let EmaraTax be your partner in navigating the tax landscape with confidence and ease.