Dabbling in cryptocurrency can feel like navigating a labyrinth, especially when tax season rolls around. Decoding complex transaction data, calculating capital gains and losses, and creating accurate tax reports can easily spin your head. Enter crypto tax software – your beacon in the chaotic world of cryptocurrency taxes. In our guide to the best crypto tax software in 2023, we’ll ease your tax-related anxieties by sharing the top tools to securely manage your financial information and pay taxes more efficiently.

So, buckle up and let’s pave the way to a smoother tax filing journey in cryptocurrency!

TurboTax Crypto Tax Software

Overview

TurboTax Crypto is a dedicated tax software that simplifies the process of reporting cryptocurrency transactions on your tax return. As the IRS considers cryptocurrency property for federal income tax purposes, trading, selling, or using it can trigger a tax event that needs to be reported.

TurboTax Crypto is compatible with various cryptocurrencies and supports different tax forms, including Form 8949 and Schedule D. Furthermore, the software’s team includes tax professionals who provide expert assistance for complex tax scenarios related to cryptocurrency.

Key Benefits

- TurboTax Crypto’s interface is user-friendly and uncomplicated, making it easy to report your crypto taxes accurately.

- The software directly imports crypto activity from numerous exchanges and wallets.

- It provides a simple way to calculate cost-basis values along with tracking your gains and losses.

- TurboTax Crypto allows users to file tax returns directly through the platform, offering a convenient approach to crypto tax reporting.

- There’s an option to convert crypto losses into tax wins, as they can diminish your taxable income and carry over any excess to future tax years.

- The software also assists in determining the fair market value of your virtual currency and provides guidance on correctly reporting your income.

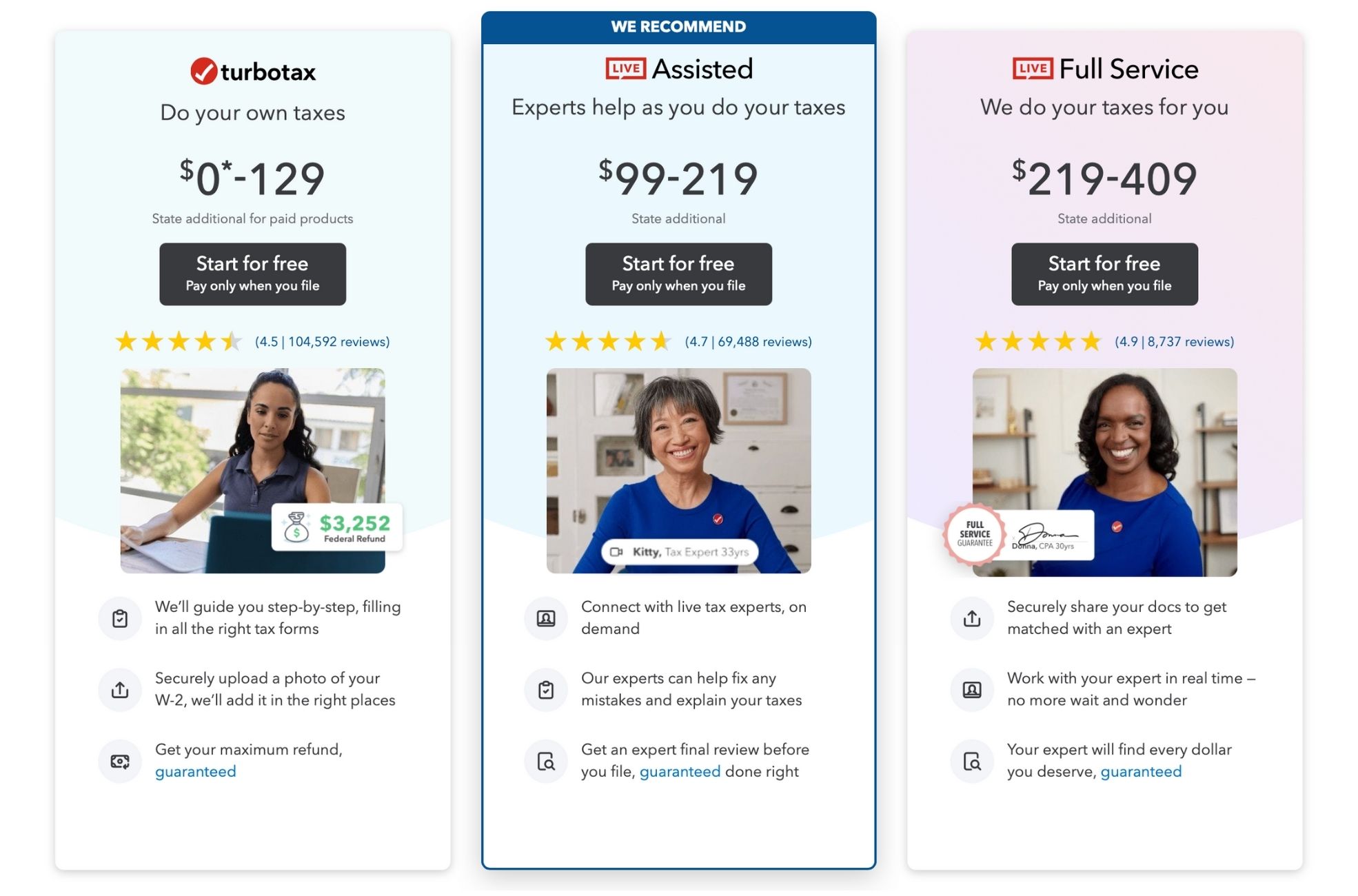

Pricing

Starting at $129, the pricing for TurboTax Crypto includes tax filing services. The software offers different plans based on your number of transactions, making it suitable for both casual and active cryptocurrency traders. However, it’s important to bear in mind that TurboTax Crypto is not a free crypto tax tool alone. Users should expect to pay for the software itself and any extra services they may require.

Pros & Cons

Speaking from experience, TurboTax Crypto offers more positives than negatives. On the pro side, the software is lauded for its ease of use, customer support, and the secure measures it takes to protect personal and financial information. Users have shared positive reviews about the user-friendly interface and the support offered by the team. The software’s features, like auto-importing crypto activity, cost-basis values, and specialised expert assistance for managing investment and crypto taxes, are also highly appreciated.

On the downside, the cost of the software can be a deterrent for some, particularly those who are new to the world of crypto trading and don’t want to invest heavily in tax software yet. However, considering the features, convenience, and expert assistance offered, we find the price to be reasonable and a worthwhile investment, particularly for those heavily involved in trading.

CoinTracker Tax Software

Overview

CoinTracker is a cryptocurrency tax software designed to track crypto portfolios and generate necessary tax forms for IRS filing. Co-founded by Chandan Lodha and Jon Lerner in 2017, the software supports over 500 exchanges, wallets, and over 2,500 crypto coins, including popular ones like Bitcoin, Ethereum, Ripple, and Litecoin.

The software offers various accounting methods for tax form generation, such as FIFO, HIFO, LIFO, Share Pooling, and Adjusted Cost Base. Designed with security as a high priority, CoinTracker uses SSL certification and encryption to protect user data. Users can also utilise its mobile app, available for both Android and iOS devices.

Key Benefits

- Convenient tax-loss harvesting analysis feature can offset gains and decrease overall tax liability.

- Compatibility with popular tax software like TurboTax, TaxAct, and H&R Block for easy data export.

- Wallet tracking, auto wallet sync, tax form generation, fee tracking, trade reports, and investment performance tracking.

- Daily updates on the value of crypto assets through the portfolio tracking feature.

- Automated cost basis and fair market value calculations for transactions using historical data.

Pricing

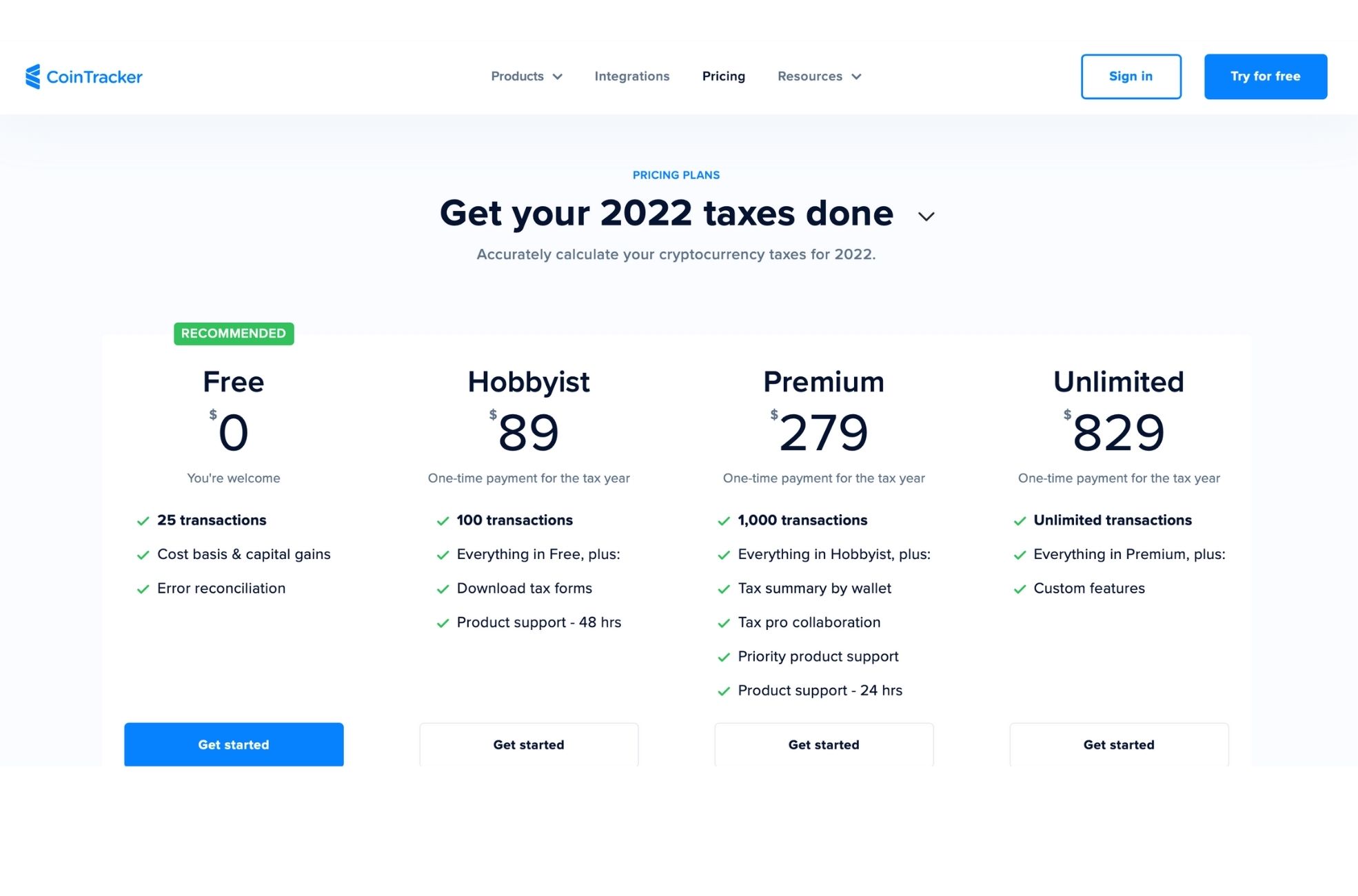

CoinTracker offers various pricing plans, from a free tier with limited transaction support to a Premium plan with advanced features like tax-loss harvesting analysis, priced at $99 per month. The pricing varies based on the subscription plan. The free plan allows up to 25 transactions, while the Hobbyist plan supports up to 100 transactions.

The Premium plan offers up to 1,000 transactions and extra features like margin trading and chat support. An Unlimited plan is also available for those requiring unlimited transactions and added support. Based on the number of transactions, the prices for the paid plans range from $49 to $299, which is competitive compared to other crypto tax software options on the market.

Pros & Cons

As a CoinTracker user, I appreciate its ability to perform complex tax calculations in minutes and handle tax-loss harvesting analysis, which helped decrease my overall tax liability. The software integrates well with centralised exchanges like Coinbase or larger DeFi protocols like Curve. However, I noticed it may incorrectly identify some tokens, necessitating manual corrections before filing taxes.

I also encountered some difficulties in adding exchanges and wallets to the platform, but the support I received was better than anticipated. Despite these minor issues, CoinTracker remains a reliable and comprehensive crypto tax software for accurate reporting of cryptocurrency transactions.

CoinLedger Tax Software

Overview

CoinLedger is a tax software tailored specifically for crypto traders who want to simplify their tax calculations. Formerly known as CryptoTrader.tax, the software permits the importation of transactions from hundreds of crypto exchanges and automatically calculates the full capital gains tax using IRS-approved accounting methods.

CoinLedger is compatible with top tax filing platforms like TurboTax, TaxAct, and TaxSlayer, allowing for a smooth transition of calculated income to these platforms for tax filing. It also supports API integrations with a host of crypto exchanges, making account history easily downloadable. The software supports over 350 cryptocurrencies and has recently expanded its integrations with blockchains like Solana and Polygon.

Key Benefits

- Automatically calculates crypto tax gains using IRS-acceptable accounting methods.

- Supports importation of transactions from hundreds of crypto exchanges.

- Integrates with popular tax filing platforms like TurboTax, TaxAct, and TaxSlayer.

- Supports API integrations with many crypto exchanges for easy download of account history.

- Supports over 350 cryptocurrencies.

- Provides clear instructions on connecting to exchange APIs or importing files from supported exchanges.

- Ensures data security with encryption of all information in transit and at rest.

- Offers live chat and email support.

- Features like tax loss harvesting, portfolio tracking, and support for NFT transactions are available.

Pricing

CoinLedger offers various pricing tiers which depend on the number of trades. The pricing starts at $49 per year for up to 100 trades and scales up to $299 per year for unlimited trades. These plans include additional features, providing flexibility to accommodate different traders’ needs.

Pros & Cons

Speaking from personal experience, CoinLedger stands out as a leading crypto tax software, offering a user-friendly interface, robust features, and competitive pricing. It is an invaluable tool for crypto traders seeking to accurately calculate their taxes and streamline the tax filing process. However, it should be noted that the software does not have a free tier for tax filing, and some exchanges may require workarounds for integration. Despite this, the platform is safe to use as it only requires read-only access to crypto exchange accounts and uses encryption technologies to safeguard data.

Koinly Tax Software

Overview

Koinly is a cryptocurrency tax software designed to simplify the process of tracking and calculating taxes on crypto transactions. Established in 2018 by Robin Singh, Koinly operates out of London and has a solid team of blockchain and tax experts working tirelessly behind the scenes. The software’s reach extends to over 350 exchanges and wallets, and it offers localised crypto tax reports for over 30 countries, making it a truly international solution.

Key Benefits

- Koinly provides robust security measures, using read-only API connections to import transactions while ensuring data is encrypted during transit. This ensures your crypto transactions remain safe and secured.

- Tax calculations on various income streams, such as staking, mining, and lending, are done automatically by the software.

- The universal wallet cost tracking feature and the crypto portfolio tracker are part of this software package.

- Its AI capabilities enable the software to accurately match transfers between wallets for cost-basis tracking.

- Extensive international support with localised tax reports is available for over 30 countries.

- The software also provides tax guides tailored for different countries, simplifying the often complex world of crypto taxes.

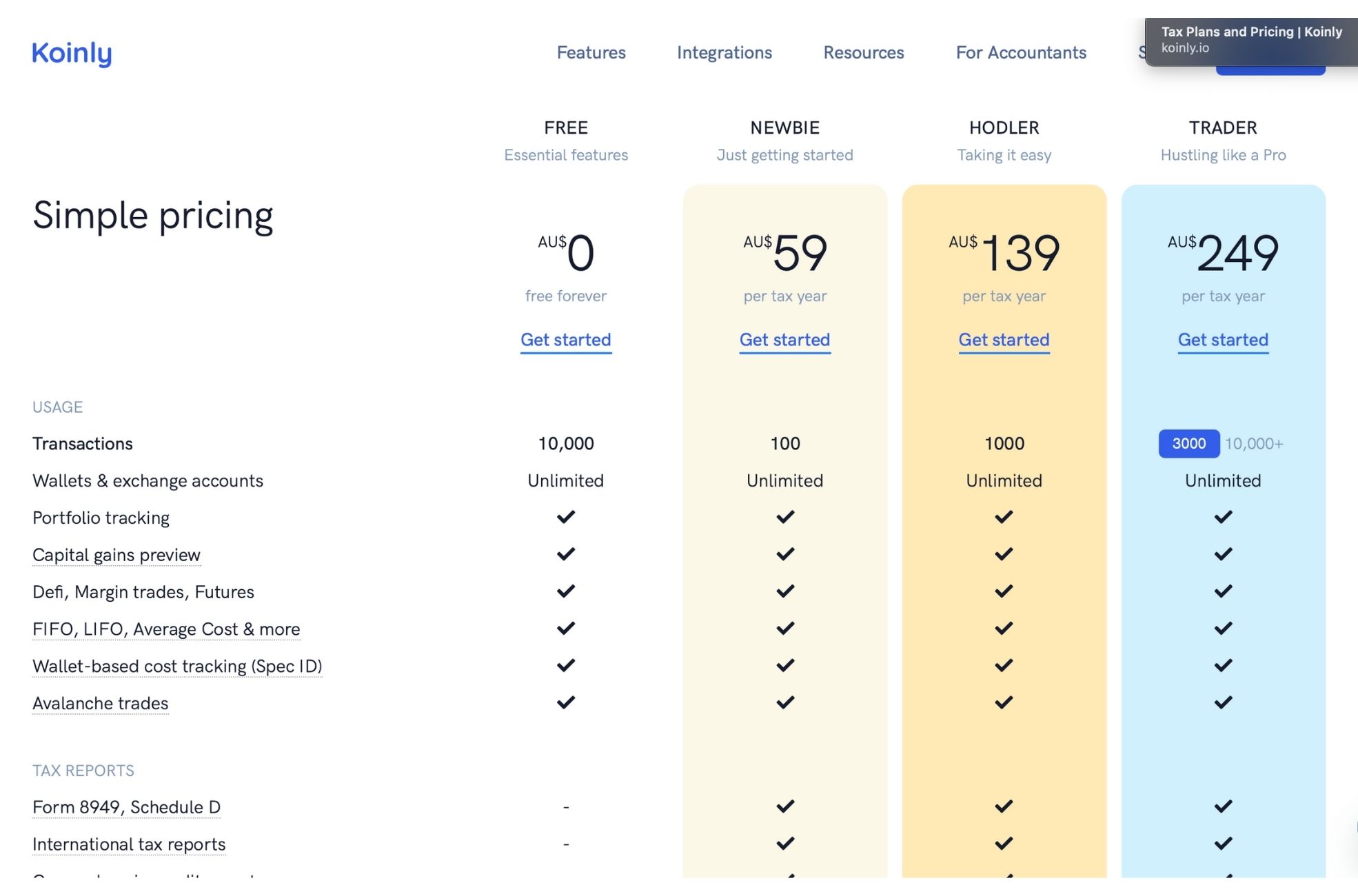

Pricing

Koinly offers various pricing plans to cater to different needs, ranging from $49 to $279. There’s also a powerful free version of Koinly, which provides portfolio tracking and tax guides, but doesn’t yet generate tax reports or official tax reports.

We found a competitor, Coin Ledger, that also offers a free trial and competitive pricing options, even providing a discount code for 10% off for those who decide to purchase the software.

Pros & Cons

From our perspective, Koinly presents an impressive package for anyone looking to manage their crypto transactions and taxes. The automatic generation of tax reports, including capital gains, income, and gift/donation reports, is a significant advantage. The software’s ability to identify multiple income streams and its robust set of tools makes it a comprehensive crypto tax solution.

However, it’s not without its shortcomings. Koinly’s support for Non-Fungible Tokens (NFTs) is currently limited, although they are actively working on expanding this feature. Another point of note is the pricing; compared to other tax software options, Koinly’s plans are on the higher side. Regardless, the software’s comprehensive features and benefits could justify the higher cost for many users.

TokenTax Tax Software

Overview

When it comes to filing taxes on cryptocurrency transactions, TokenTax has carved a niche for itself. As a specialised tax-filing company, they provide both full-service tax-filing software and a standalone application that can calculate crypto trade taxes. TokenTax integrates smoothly with various centralised and decentralised exchanges and can import trading data directly or via CSV file uploads.

You can generate tax forms with their software and import them into TurboTax, making the filing process a breeze. Plus, they offer back-tax filing for crypto traders with inaccurate data dating back to 2014.

Key Benefits

- Specialises in crypto tax optimisation, providing a targeted solution for crypto traders.

- Compatibility with a wide range of exchanges allows for easy trade data import.

- Generates tax forms that can be used with TurboTax for seamless filing.

- Offers back-tax filing, perfect for individuals with inaccurate data from previous years.

- Features include tax-loss harvesting, support for margin trading, and comprehensive tax reports.

- The dedicated support team is reachable through the platform’s help centre, live chat, email, or phone.

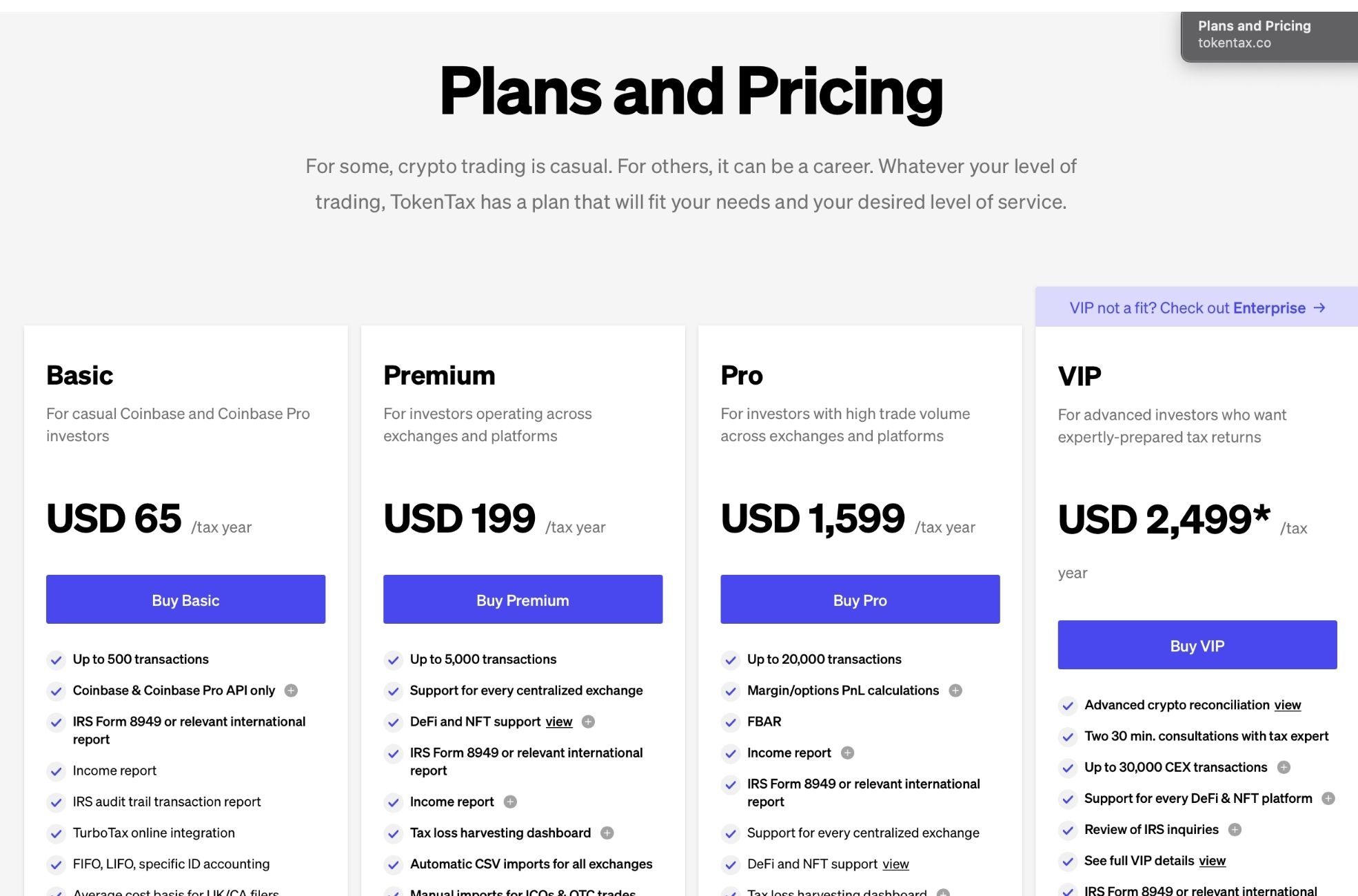

Pricing

TokenTax offers various pricing plans, starting from $65 per year to $3,499 per year, depending on the level of service required and the number of transactions being handled. Each plan offers different features, with the basic plan including TurboTax integration and unlimited tax form revisions. Premium and pro plans offer more advanced features like tax-loss harvesting and margin trading support. High net-worth individuals can avail of the VIP plan. However, TokenTax does not offer a free version of its service.

Pros & Cons

From our perspective, TokenTax provides a robust solution for crypto tax filing. Their user-friendly interface and live chat support make them a solid choice for those needing assistance with their crypto taxes. Despite being more expensive compared to some competitors, the full-service filing option is a boon for those with complex tax situations. However, it’s important to note that they don’t offer a free trial or refund period. Still, they’ve built a good standing in the crypto tax calculator industry, boasting a 4.3/5 rating on Trustpilot.

Awaken.Tax Tax Software

Overview

Awaken.Tax is a comprehensive tax software specifically designed for those dealing with cryptocurrencies’ unique needs. This software handles a wide variety of transactions, including trading, borrowing, lending, and staking of cryptocurrencies, making it a versatile tool for individuals involved in the crypto space. Notably, it supports major blockchains and exchanges.

Key Benefits

- Automatic classification of transactions, simplifying the process of understanding tax obligations

- Support for complex transactions related to cryptocurrencies

- Compatibility with major blockchains and exchanges, accommodating a wide range of cryptocurrencies

- Provides functionalities for tax management, tax reports, and transaction history

- Includes features for tax loss harvesting, which allows offsetting capital gains with capital losses

- Available 24/7 customer service

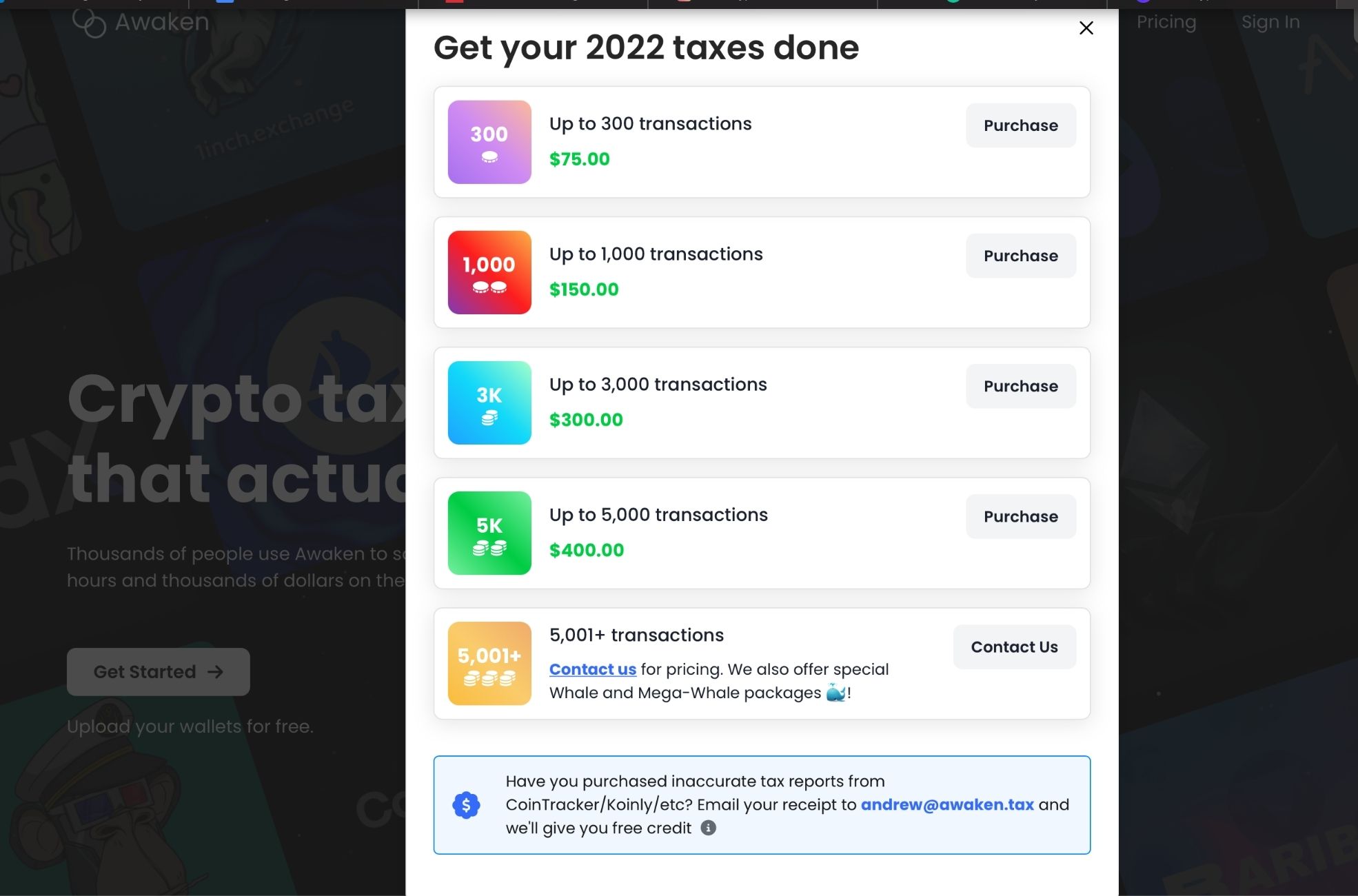

Pricing

Awaken.Tax offers free access to transaction history and tax summaries. However, users will need to pay when they wish to download their tax reports. The pricing structure is based on the number of transactions, starting at $30 for 100 transactions, and can go up to $500 for 10,000 transactions. This makes it an affordable option for individuals, especially those with fewer transactions.

Pros & Cons

From our experience with Awaken.Tax, we found it to be one of the best performers among other crypto tax software. It scored 4.8 out of 5 in our tests for its simple and intuitive interface, high degree of accuracy, automation, and support for complex transactions. The software’s high degree of accuracy reduces the risk of errors and ensures compliance with all tax laws and regulations.

However, we noted that Awaken.Tax does not provide an API. Despite this, it does offer a range of functionalities for tax management, tax reports, and transaction history. The software also successfully calculates crypto gains and losses and takes into account all complexities related to crypto transactions. This makes it a reliable tool for accurate reporting.

During the test, we observed that the software correctly recognised the loss incurred due to transaction fees and the disposal of the NFT. This was not the case with some other providers, which recorded large gains when swapping USDC for ETH and did not recognise the disposal of the NFT as a loss. Also, certain providers did not deduct transaction fees properly.

Overall, using Awaken.Tax can save time and money by simplifying the process of calculating and reporting cryptocurrency taxes. Its 24/7 customer service ensures that assistance is always on hand.

ZenLedger Tax Software

Overview

ZenLedger is a specialist tax software that accommodates the needs of cryptocurrency investors. Its functionality focuses on the tracking and reporting of capital gains, mining income, gas fees, and staking rewards, all tailored towards tax purposes. ZenLedger integrates with over 400 cryptocurrency wallets and exchanges to make the process seamless, enabling users to import transaction history and holdings into its dashboard.

The software’s versatility also extends to over 100 DeFi protocols and 10+ NFT platforms. And for a complete tax reporting solution, ZenLedger integrates with popular tax platforms such as TurboTax and TaxAct.

Key Benefits

- ZenLedger offers comprehensive tax reports, including IRS Schedule 1, Schedule D, and Form 8949.

- Features a tax-loss harvesting tool to offset capital gains with losses.

- Provides a Grand Unified Accounting tool for an overview of transactions across multiple exchanges and wallets.

- Supports reports for mining and staking income, audit trails, and margin trading.

- Has a tool to calculate the cost basis for cryptocurrency donations.

- Excellent customer support, available 7 days a week via phone, video, or chat.

Pricing

ZenLedger has a variety of pricing plans designed to cater to diverse needs. Its free plan offers basic portfolio tracking and transaction aggregation. There are paid plans available for more advanced features, such as tax-loss harvesting and unified accounting. Prices range from free to $999 per year, depending on the features and level of support you require.

Pros & Cons

ZenLedger boasts a number of strengths, such as its ease of use, top-notch customer support, and the ability to consolidate and track cryptocurrency transactions across multiple exchanges and wallets. What’s more, it’s trusted by the IRS and implements secure data protection measures, including encryption and read-only access to transaction data.

But it’s worth mentioning that some users have reported limitations with the software. These include issues with certain exchanges not being supported and difficulties manually editing and verifying transactions. Additionally, free accounts may find their features rather limited, and the software’s availability is not global.

Accointing Tax Software

Overview

Accointing is a versatile cryptocurrency tracking and tax reporting tool designed for crypto enthusiasts, traders, or investors. The software supports a plethora of exchanges and cryptocurrencies, making it a one-stop solution for anyone involved in the crypto market. With more than 400 exchanges and 20,000 cryptocurrencies in its arsenal, it’s no surprise that Accointing has a strong user base across different countries.

While it’s optimised for users in the U.S., U.K., Australia, Germany, and Switzerland, it can be used anywhere. It also integrates with leading exchanges and decentralised finance (DeFi) platforms, allowing users to consolidate their crypto assets in one place.

Key Benefits

- Streamlined crypto tracking: Accointing simplifies the process of tracking and managing cryptocurrencies across different platforms.

- Tax reporting made easy: The software effectively automates tax reporting, ensuring accurate and efficient filing.

- Variety of accounting methods: Accointing supports FIFO, LIFO, and HIFO methods for calculating gains and losses, catering to different user preferences.

- Comprehensive portfolio overview: The platform provides a detailed summary of your crypto portfolio, including buy and sell dates, net profit, and overall gains.

- Potential tax-saving opportunities: Accointing’s holding period tool helps identify tokens held for over a year or less, offering potential tax-saving insights.

- Compliance with tax authorities: The platform is fully compliant with tax authorities in supported jurisdictions, adding an extra layer of security.

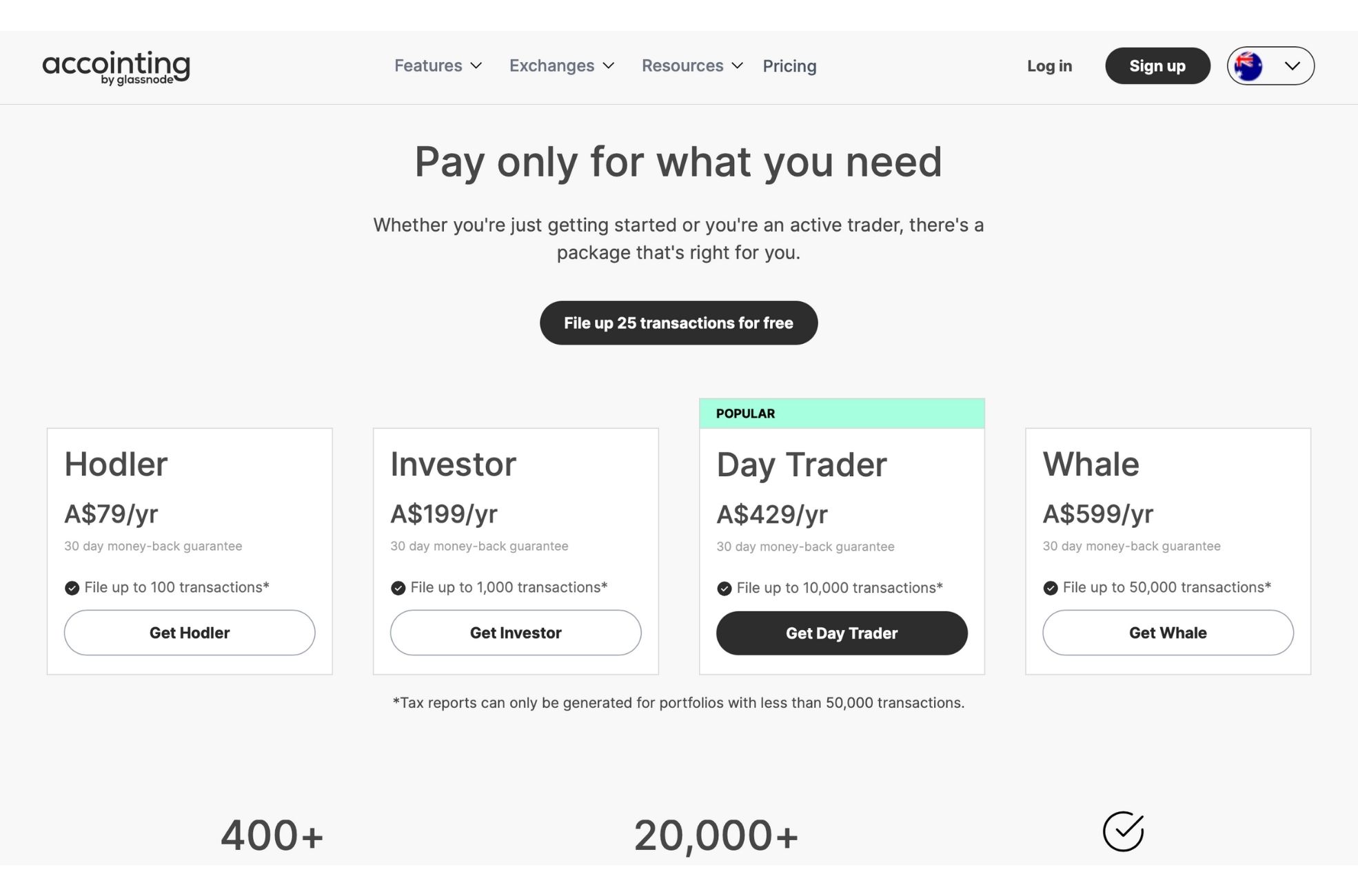

Pricing

Accointing offers a structured pricing model based on the number of transactions, making it accessible for different types and sizes of crypto traders and investors. While it allows free tracking for a limited number of exchanges, wallets, and digital assets used, there are paid plans for those with more than 25 transactions per year. The pricing tiers vary in line with the level of support and number of transactions needed. To offer a risk-free experience, Accointing provides a free trial as well as a 30-day money-back guarantee.

Pros & Cons

As a user of Accointing, we’ve found numerous advantages. The platform is incredibly user-friendly, with a mobile app that makes it easy to track portfolios anywhere, anytime. Its tax reporting feature is a standout, generating tax forms and reports that make tax filing a breeze. And with its wide range of features and integrations, it’s a comprehensive solution for all your crypto tracking and tax reporting needs.

On the downside, while Accointing offers free tracking for a limited number of assets, the costs can add up for those with larger portfolios or more frequent transactions. However, considering the accuracy, ease of use, and peace of mind it brings, we believe it’s a worthwhile investment.

What Is Crypto Tax Software?

Crypto tax software is a specialised tool designed to help individuals and businesses track, calculate, and report their tax liabilities stemming from cryptocurrency transactions. It automates the complex process of recording transaction data, calculating capital gains and losses, and generating accurate and compliant tax reports. These software solutions ensure accurate and efficient tax filing, particularly for those who regularly engage in cryptocurrency trading or investment activities.

One of the key advantages of crypto tax software is its ability to integrate seamlessly with various cryptocurrency exchanges and digital wallets. This feature allows for the automatic import and organisation of all transaction data into a single, easy-to-manage platform, eliminating the need for manual record-keeping and significantly reducing the risk of errors in tax calculations.

Aside from basic functionalities, some crypto tax software options offer advanced features such as smart transfer matching, double-checking capabilities, and tax-loss harvesting. These sophisticated features provide an additional layer of accuracy and efficiency, making the tax reporting process even more seamless.

Security is a paramount concern when dealing with sensitive financial data. Hence, trusted and reliable crypto tax software ensures tax agencies have the highest level of data protection through robust encryption technologies and secure data handling protocols.

Overall, the use of crypto tax software can save significant time and effort, particularly for those who engage in numerous transactions or have complex trading activities. It provides ready-to-use, compliant tax paperwork, such as IRS Form 8949, making tax filing more efficient. It also aids in maintaining accurate end-of-year balances, which is essential for seamless tax reporting in subsequent years.

However, choosing the right crypto tax software requires thoughtful consideration of factors such as exchange and wallet compatibility, customer support, user interface, and final output accuracy. It is also recommended to compare the final results of different crypto tax tools to ensure the maximum accuracy possible.

The Benefits of Tax Software

Crypto tax software tools come with a plethora of benefits tailored to streamline the often complex and arduous process of tracking, calculating, and reporting cryptocurrency transactions for tax purposes. With the rise of cryptocurrency investment and trading, these tax reports and tools have become increasingly necessary for individuals and businesses to effectively manage their tax liabilities.

One of the most significant benefits of these software solutions is their ability to automate processes that would otherwise require extensive manual work. These tools can automatically import all transaction data into a single, easy-to-manage platform by integrating with various exchanges and wallets. This greatly reduces the time and effort required to record transaction data and significantly minimises the risk of errors in tax calculations that could lead to penalties or fines.

Another major benefit of crypto tax software platforms is their sophisticated features. This includes smart transfer matching, double-checking capabilities, and tax-loss harvesting. These features provide an additional layer of accuracy and efficiency to the tax reporting process, making it more seamless and manageable.

Additionally, crypto tax software provides users with ready-to-use tax paperwork, such as tax documents such as IRS Form 8949. This ensures that tax filing is more efficient, accurate, and compliant with IRS requirements. Moreover, these tools also help maintain accurate end-of-year balances, a crucial component for seamless tax reporting in subsequent years.

Lastly, the security measures employed by these software solutions cannot be understated. Given the sensitive nature of financial data, it’s imperative that users choose a trusted and reliable crypto tax software-free solution. The best crypto tax software solutions ensure the highest level of data protection through robust encryption technologies and secure data handling protocols.

Wrapping Up The Best Crypto Tax Software

In conclusion, crypto tax software is invaluable for individuals and businesses involved in cryptocurrency trading or investment activities. It simplifies the complex process of tracking, calculating, and reporting tax liabilities while providing advanced features and ensuring data security.

By leveraging these crypto taxation software solutions, individuals and businesses can confidently and confidently navigate the cryptocurrency tax terrain.