If you are considering Dubai as your business destination, did you know that you can establish your own Holding Company in UAE? A holding company lets you enjoy several advantages, such as the protection of assets, tax efficiency, limited liability, and much more.

Fortunately, opening your holding company in Dubai is relatively easy and does not require investing a hefty amount of capital. In this article, we will explain in detail what a holding company is and how it works in the UAE, the benefits of having a holding company in UAE, the types of companies allowed, the prerequisites to open a holding company, the costs involved, and much more.

What is a Holding Company?

A holding company is a legal entity that owns other companies’ assets and/or shares. It does not engage in any business activity itself, but it holds its subsidiaries to manage them. It also protects its shareholders from liability issues by isolating their assets from the liabilities of its subsidiaries.

Like many other business formats, holding companies are also popular in the UAE for foreign and local investors and entrepreneurs. It is desirable for those who want to consolidate their corporate investments into one entity and enjoy ownership benefits.

We will now explore how the holding companies in the UAE operate in the UAE.

How Do Holding Companies Work In UAE?

Holding companies in Dubai and elsewhere in the UAE work within the country’s business framework. Holding companies can own shares of other companies but cannot be involved in a commercial activity like trading, manufacturing products, or providing customer services.

There is no specific paid-up capital requirement for you to form and own a holding company in UAE, simplifying the company formation process and reduces entry barriers in the market. You can own a holding company with as little as $1 as a minimum capital.

Allowed Activities for Holding Companies

A holding company in the UAE can own and manage shares of other companies in any business sector. The holding company or parent company can also own both physical and intellectual assets of the subsidiaries under its management and ownership. However, the parent company cannot undertake direct business activities except for some level of managerial control over its subsidiaries.

Types of Holding Companies in UAE

There are two major holding company types you can establish in the UAE.

Mainland Holding Company

Your first option is establishing an onshore or mainland holding company. The UAE law requires registering any holding company as a commercial business or activity. UAE’s Ministry of Economy (MoE) is the regulatory body for such establishments, and you must adhere to the UAE’s Companies’ Legislations.

The legislation allows your mainland holding company to conduct commercial and administrative activities through the subsidiary companies within the UAE and abroad without engaging in direct trading or commercial activities.

Free Zone Holding Company

The other option is to open a Free Zone Holding Company. The UAE government has established over 60 economic Free Zones across the major Emirates of UAE, including Dubai, Abu Dhabi, and Sharjah, to facilitate foreign investment and commerce.

A Free Zone allows you to operate with greater flexibility and offers several incentives, such as generous tax exemptions, no currency restrictions, and the ability to repatriate 100% of your profits and principal investment.

To start a Free Zone Holding Company in UAE, you must first choose from one of the many business-friendly free zones available in the country. This includes Dubai International Financial Centre (DIFC), Jebel Ali Free Zone Authority (Jafza), Abu Dhabi Global Market (ADGM), Sharjah Airport International Free Zone (SAIFZ), and many others.

The UAE government has also announced that the free zone businesses will continue to enjoy zero corporate taxation.

Step-by-Step Guide: How to Open a Holding Company in the UAE

Step 1: Choose Business Type and Arrange Documents

When setting up a UAE-based holding company, you have two main options: Free Zone or Mainland. Mainland companies typically register as LLCs for asset protection, requiring specific documents, including a business registration form and IDs. Free Zone entities, usually set up as FZEs or FZCs, require a NOC from the zone’s authority and offer benefits like full foreign ownership. Both setups might need a parent company’s documents if establishing a branch. It’s crucial to weigh each structure’s advantages before deciding. Once you have chosen your business structure, you can register your company.

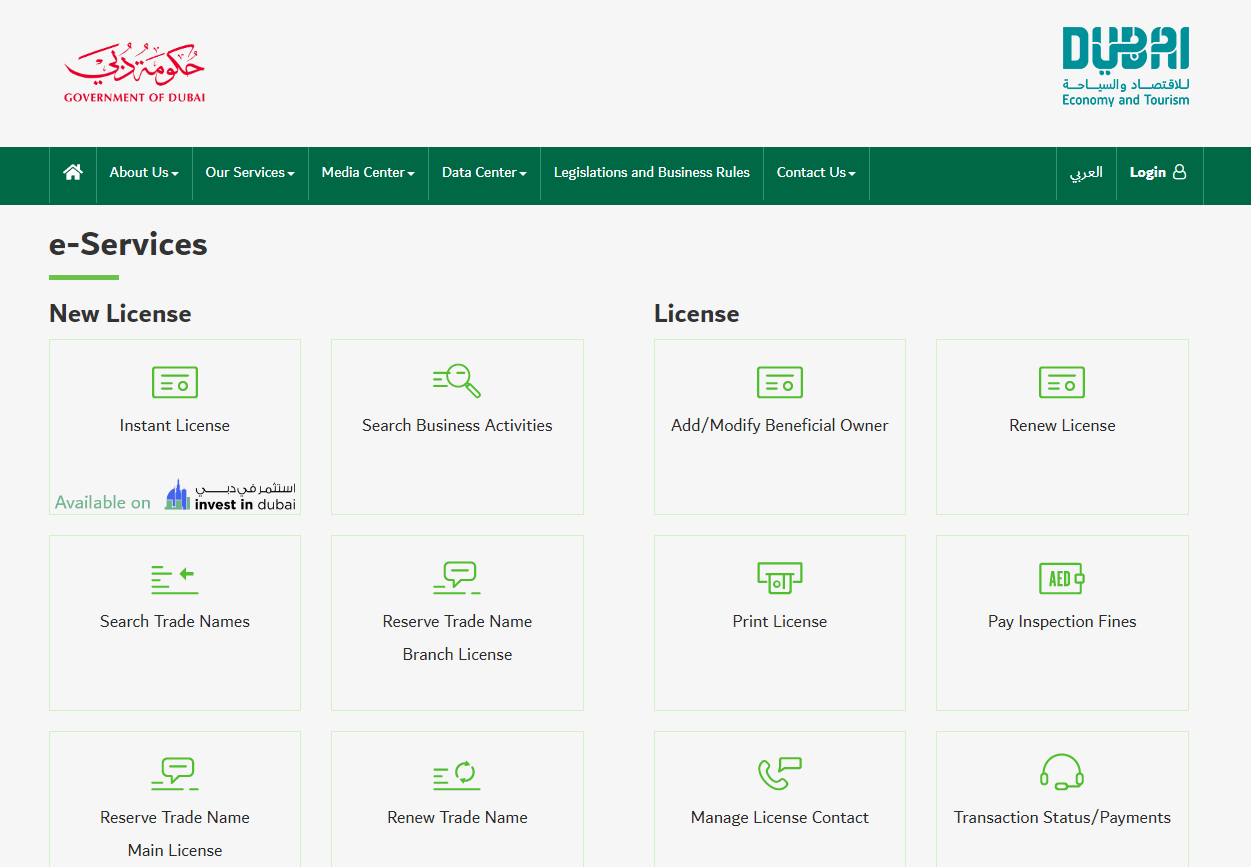

The DED, the regulatory body for any commercial licence in Dubai, has outlined the documentation requirement for any new businesses, including holding companies. Depending on your business structure, you may need a few of the following documents:

- Filled up business registration and licensing form

- Identification documents for the owner and all the partners

- Copy of valid residence permit in Dubai

- No objection certificate for the non-GCC nationals to participate in a commercial activity

- No objection certificate from a free zone (if you are applying for a free zone holding company)

- Parent company’s board resolution if the holding company intends to act as a branch

- Copy of parent company’s incorporation documents (applicable for branch establishments)

Step 2: Open a Corporate Bank Account

Opening a corporate bank account is a crucial step for a holding company in the UAE. Start by choosing a bank that suits your business needs and understand their requirements for corporate accounts. You will likely need to present your company’s licence, shareholder and director identification documents, and possibly a business plan. An in-person meeting at the bank may also be required. This account will be essential for managing your company’s financial transactions, receiving payments, and handling operational expenses.

Step 3: Choose A Legal Name

Next, you must choose a commercial name for your holding business entity. The UAE business incorporation legislation requires you to choose a different name for your holding company that does not resemble any of the subsidiary’s names. The distinction will help keep the parent company and the substitutes separate.

You can choose a commercial name from DED’s Invest in Dubai website, where you can enter various business names and check for availability.

Step 4: Ensure Compliance

Finalize registration with the UAE authorities to comply with local regulations and secure necessary approvals. Establish internal policies for subsidiary management, focusing on compliance and risk management, to maintain financial integrity and legal standing.

Step 5: Apply for Licence

You must apply for your commercial licence for your holding company in Dubai.

To determine the type of commercial licence needed for a holding company in the UAE, consider your business activities and location. Mainland companies usually require a Commercial or Professional Licence, whereas Free Zone companies must adhere to the specific licencing requirements of their chosen Free Zone. Consulting with the Department of Economic Development (DED) or the Free Zone authority can provide guidance based on your business structure and activities.

When applying for a licence for your holding company, start with obtaining initial approval from the Department of Economic Development (DED) if you’re setting up in Mainland Dubai. To form a similar business in Abu Dhabi, you must obtain a licence from the Abu Dhabi Department of Economic Development (ADDED). This approval is essential for office space rental and seeking permissions from other authorities. After securing initial approval and a tenancy agreement, submit these with the necessary documents to DED for the full licence. For Free Zone setups, seek approval directly from the desired Free Zone authority before applying for the licence, as each zone has its unique process.

Costs of Establishing a Holding Company in UAE

Some of the costs associated with your holding company formation in UAE include:

- Initial approval: AED 120

- Trade name registration: AED 600

- Licence application: AED 600

Responsibilities of the Management Board

The UAE government has set up a range of rules and regulations for a holding company. The holding company must appoint a management board with multiple authorised persons who will make managerial and top-level decisions on how the subsidiaries will run. Below are some of the essential responsibilities of the management board:

- Continuous supervision: The management must establish a formal procedure to supervise the subsidiary companies’ business activities continuously.

- Appointment of director: The board must appoint a director who will represent the management board in coordinating with the subsidiary companies. The director will also supervise the day-to-day business activities conducted by the subsidiaries to ensure legal and operational compliance.

- Capital requirement: Although regulatory bodies have not set a specific paid-up share capital for the holding company, you must ensure that all the subsidiaries have adequate capital available to run their operations.

- Risk management: It is also the responsibility of the holding company’s management board to make strategic decisions about risk management and risk exposure of the subsidiaries. They can do it by setting up a loan limit or debt-to-equity ratio. The board can also decide on other risk exposures like industry or currency risk.

- Contact management: The board must ensure that all of its subsidiaries honour the contracts and agreements with suppliers, vendors, and other stakeholders.

- Separation of the subsidiaries: As a holding company, your business can hold one or more than one business. However, if you own more than one subsidiary, you must keep all entities’ assets and responsibilities separate. The separation will also protect you during legal disputes or liquidation if the business condition goes downhill.

The 10 Benefits of a Holding Company in UAE

Creating a holding company in Dubai and other parts of the UAE has several advantages. Here are some of them:

1. Asset Protection and Limited Liability

In a UAE holding company, Asset Protection and Limited Liability work together to secure your investments and subsidiary assets against legal challenges and financial risks. This structure differentiates between entities handling operations and those holding assets, ensuring the latter are safeguarded from operational liabilities, legal disputes, and financial instabilities. It effectively prevents the repercussions of one subsidiary’s difficulties from affecting others, thereby protecting the company’s overarching financial health and promoting investor confidence.

2. Risk Management

Risk Management in a holding company structure in the UAE allows for the strategic distribution of financial and legal risks across its subsidiaries. By doing so, it isolates the impact of any adverse events to a specific part of the business without jeopardizing the entire group. This approach not only safeguards the holding company’s overall financial health but also provides a more stable environment for growth and investment, enhancing resilience against market volatility and legal challenges.

3. Tax Efficiency with Offshore Status

A holding company in the UAE will benefit from tax savings since income earned by foreign companies is not yet taxable in the UAE. Moreover, you can also benefit from double tax treaties with more than 80 countries across Europe, Asia, and Latin America.

4. Establishing Credit

You will find it easier to establish credit with banks, creditors, and other organisations, as the lenders will consider the financial strength of the subsidiaries managed by the parent company. Interestingly, you can acquire a loan for your holding company and invest it in other assets.

5. Governmental Support in the UAE

The UAE government provides businesses with a supportive and friendly environment. Moreover, they offer several incentives to foreign investors through tax exemptions, trade privileges, and more.

6. No Minimum Share Capital Requirement

To encourage foreign and local investment, the UAE government does not impose a minimum amount of paid-up share capital you must invest. This makes the entire business registration and formation process easy and affordable for many investors.

7. Market Expansion

Market Expansion through a holding company enables strategic diversification, facilitating entry into new sectors and geographical areas with reduced operational risk and increased efficiency. This structure supports a company’s growth ambitions by leveraging the consolidated strengths of its subsidiaries, allowing for a more agile response to market opportunities and challenges, both within the UAE and internationally.

8. Investment Opportunities

Investment Opportunities in a holding company enhance the appeal to investors by pooling the resources and strengths of its subsidiaries. This collaborative approach amplifies the company’s market presence and financial stability, making it more attractive for external investment.

9. Operational Efficiency

Operational Efficiency is achieved by centralizing essential functions, which minimizes redundancy and lowers costs. This streamlined structure enables better allocation of resources across the group, improving overall performance and competitiveness.

10. Different Company Structure Options

You can form a holding company through various corporate structures depending on your investment, preference, and business type. Your company can take any one of the following formations:

- Partnership business

- Limited liability company or LLC

- Joint stock company

- Free zone business

Holding Company in UAE

A holding company in the UAE is a great way to manage and protect your assets. It also offers many benefits such as tax efficiency, lower risks, no specific share capital requirement, greater flexibility, and greater diversification of the subsidiary companies.

Although the process is straightforward, you must prepare all documentation and complete the paperwork correctly for a streamlined experience. Virtuzone’s industry-leading business consultants have significant expertise in business formation in Dubai and the UAE. Reach out to us today to make things easy for you and get started with your holding company in UAE.

FAQs

Is Dubai a Good Place for a Holding Company?

Dubai is considered a favourable location for establishing a holding company due to its strategic geographical position, robust economic environment, and investor-friendly policies. The emirate offers tax advantages, including no personal income tax and corporate tax exemptions for certain types of businesses, alongside world-class infrastructure and a stable political climate. Additionally, Dubai’s free zones provide added benefits such as 100% foreign ownership, full repatriation of profits, and streamlined business setup processes, making it an attractive destination for holding companies looking to expand globally.

Why Do Companies Create Holding Companies?

Companies create holding companies for several reasons, including asset protection from liabilities, efficient management and control over subsidiaries, tax optimization strategies, and investment and growth opportunities. Holding companies allow for the separation of operational risks from asset ownership, provides a streamlined approach to managing diverse business interests, and can offer financial benefits through consolidated tax filings and strategic tax planning.