The United Arab Emirates has long been renowned as a tax haven, drawing in businesses and investors worldwide with its strategic location and business-friendly environment. According to Tax Justice Network, a global advocacy group of taxation and economy researchers, an estimated USD $200bn flowed into the country in 2021. But what is corporate tax for mainland companies? Come July 2023, this allure of a UAE tax haven will be tested with a new corporate tax regime coming into effect.

This new taxation landscape presents opportunities and challenges for entrepreneurs and investors alike. So it’s paramount to stay ahead of these changes to remain compliant, minimise liabilities and maintain competitiveness on the global stage.

Whether you’re a seasoned business owner in the UAE or just starting as an entrepreneur, join us as we venture into UAE corporate tax for mainland companies. We’ll uncover hidden opportunities and establish a path to success in this ever-changing environment. Let’s get started!

Source: Pexels

UAE Corporate Tax Background and Landscape

A quick overview of the corporate tax landscape in the UAE will help us understand the changes that are taking place.

Corporate Tax Landscape Before 2018

The UAE has been a tax-free jurisdiction since its inception. As such, it’s exempt from federal income taxes and levies by local governments. This allowed entrepreneurs and investors alike to reap the benefits of their hard work without any extra burden on their bottom line.

The favourable tax environment has helped the UAE become a significant player in the global economy and encouraged diverse industries to set up shops within its borders.

The government largely depended on oil revenue to fund its budget. However, due to the global decline in oil prices and a shift towards renewable energy sources, this source of income became unreliable.

Source: Pexels

Introduction of VAT in 2018

In 2018, the UAE introduced a Value Added Tax (VAT) to diversify its income sources and reduce its reliance on oil. VAT is an indirect tax applied to most goods and services at each stage of production and distribution. This new taxation system came into effect on January 1st, 2018, with a standard rate of 5% VAT.

However, specific sectors, such as education, healthcare, international transportation of passengers and goods, precious metals required for investments etc., are exempt from VAT. Furthermore, businesses with an annual turnover below AED 375k are exempt from registering for VAT.

Introduction of Corporate Tax for Mainland Companies

The UAE government announced a new corporate tax regime in early 2022 that will come into effect from June 2023. Under this regime, mainland companies with a specific annual profit will be liable to pay corporate taxes.

This move is part of the government’s efforts to diversify its income sources and reduce its reliance on oil. This taxation system is expected to generate significant revenue for the country and create a level playing field between local businesses and multinational corporations operating within the UAE borders.

Entities and Organisations with Tax Exemptions

While the new corporate tax regime significantly changes the UAE’s taxation landscape, the Ministry of Finance (MOF) has outlined several exemptions for specific entities. If your mainland venture falls under one of these exemptions, you won’t need to file a tax report or pay taxes. Let’s take a closer look at the exempt entities:

- Public organisations: Government and public entities are exempt from the new corporate tax requirements.

- Social and charitable: Organisations dedicated to charitable and social causes can also be exempt from corporate tax. However, these organisations must first register as social or charity organisations with the MOF and obtain clearance from the relevant authorities.

- Mining: Businesses involved in extracting or mining natural resources within the UAE are already subject to Emirate-level taxation and, therefore, are not required to file separate corporate tax reports.

- Regulated investment: Real estate and other regulated investment funds can apply for exemptions from corporate tax. Like charitable organisations, these funds must seek approval from the MOF and the Federal Tax Authority (FTA) to secure formal exemption status.

- Social funds: Public and regulated private entities that manage social benefit funds, such as pension or retirement planning, are also eligible for tax exemptions.

- Exemptions with special permission: UAE companies wholly owned by the UAE government and listed with a ministry-level decision for tax exemption are also exempt from the new corporate tax regime.

Understanding these exemptions is crucial for businesses operating in the UAE, as it may help eligible organisations save on taxes and focus their resources on achieving their goals.

Source: Pexels

Which Are UAE Mainland Companies?

Mainland companies in the UAE are businesses registered with the Department of Economic Development (DED) in one of the seven emirates. These companies enjoy unrestricted access to local and global markets, giving them a clear edge over their counterparts operating out of free zones, which have certain restrictions on their scope of activities and market reach.

Moreover, mainland companies can bid for public sector contracts and tenders, providing them with a valuable opportunity for growth through collaboration with various government entities. Unsurprisingly, many entrepreneurs view UAE mainland registration as an attractive option due to its favourable business environment and potential for success in this rapidly changing economy.

Corporate Tax Compliance for Mainland Companies

Mainland companies in the UAE must stay abreast of their tax obligations to ensure compliance and avoid legal repercussions. Failing to pay taxes can result in a jail sentence of up to six months plus an AED 100,000 fine. As of June 1, 2023, all mainland businesses will be subject to a 9% corporate tax on profits.

Here are some key aspects to consider for tax compliance:

- Register for corporate tax: Mainland companies need to register for corporate tax with the Federal Tax Authority (FTA) and obtain a tax identification number.

- Maintain accurate financial records: Keep detailed and accurate financial records, including income, expenses, and assets, to ensure a smooth tax filing process.

- Comply with filing deadlines: Adhere to the specified tax filing deadlines to avoid penalties for late submission.

- Calculate taxable income: Determine your company’s income by considering various factors, such as revenue, expenses, and applicable deductions.

- Pay taxes on time: Ensure timely payment of taxes to avoid fines and legal consequences.

- Seek professional advice: Engage the services of a tax consultant or advisor to help navigate the complex tax landscape and ensure compliance with all relevant laws and regulations.

By staying informed about the new corporate tax regime and adhering to these guidelines, mainland companies can minimise their tax liabilities, avoid legal issues, and maintain a strong reputation in the UAE market.

Source: Pexels

Will Free Zone Businesses Subject to Corporate Tax?

The UAE government has long been dedicated to providing a business-friendly climate with reduced taxation for free zones, and this commitment continues even with the introduction of the new corporate tax regime in 2023.

Free zones are designated areas within the UAE that offer special economic incentives and reduced taxation to attract foreign investment and promote business growth. These zones often cater to specific industries and provide numerous advantages such as 100% foreign ownership, streamlined business setup processes, and exemption from import/export duties – all of which will still apply under the new tax regime.

Although technically subject to taxation due to the new rules, free zone businesses will be set at a 0% tax rate. This means they can still operate in a tax-free environment and enjoy the same benefits. The decision to maintain this 0% rate indicates the UAE government’s commitment to honouring its promise of reduced taxation, attracting foreign investment, fostering innovation, and promoting economic growth across all industries.

Corporate Tax Calculation for Mainland Companies

The Ministry of Finance (MOF), the regulatory body for UAE corporate tax, has established a tiered taxation policy for mainland companies. This policy considers a company’s net yearly profit as taxable income to determine the appropriate tax rate. Here’s a breakdown of the three taxation tiers:

Tier 1: Businesses with Net Yearly Profits up to AED 375,000

Companies in this tier, with a net yearly profit of up to AED 375,000, will be subject to a 0% tax rate. This tax-free status aims to support small and medium-sized enterprises and encourage their growth within the UAE market.

Tier 2: Businesses with Yearly Net Profit Above AED 375,000

Mainland companies with a net yearly profit exceeding AED 375,000 will be subject to a 9% tax rate on the amount over AED 375,000. This moderate tax rate reflects the UAE government’s commitment to maintaining a business-friendly environment while generating revenue for public services and infrastructure projects.

Tier 3: Large Multinational Companies

Large multinational companies will be subject to a separate taxation policy under ‘Pillar Two’ of the OECD Base Erosion and Profit Shifting (BEPS) project. Companies with a total global revenue exceeding EUR 750 million (equivalent to AED 3.15 billion) fall under this category. This policy aims to prevent tax evasion and ensure that these large corporations pay their fair share of taxes in the countries where they operate.

Source: Pexels

Example of Tax Calculation

Let’s consider a hypothetical example to better understand the corporate tax calculation for mainland companies in the UAE. Suppose there’s a Dubai-based mainland company with a net yearly profit of AED 489,000. Based on the tiered taxation policy, we can calculate the company’s corporate tax as follows:

Since the company’s net yearly profit exceeds AED 375,000, it falls into the second tier, subject to a 9% corporate tax rate. To calculate the tax payable, we first need to determine the taxable income by subtracting the threshold of AED 375,000:

Taxable Income = Yearly Net Profit – Threshold Amount

Taxable Income = AED 489,000 – AED 375,000

Taxable Income = AED 114,000

Now, we can calculate the tax payable using the following formula:

Tax Payable = Taxable Income × Corporate Tax Rate

In our example, the tax payable would be:

Tax Payable = AED 114,000 × 9%

Tax Payable = AED 10,260

Thus, the Dubai-based mainland company must pay AED 10,260 in corporate tax under the new tax regime.

Tax Deductible Expenses

When preparing their corporate tax returns, mainland companies in the UAE must be mindful of the expenses that can be deducted for tax purposes and those that cannot. As outlined by the Ministry of Finance (MOF), the following expenses are not eligible for tax deductions:

- Bribes

- Fines and penalties

- Donations, grants, or gifts (Exceptions: Qualifying Public Benefit Entities)

- Dividends and other profit distributions

There are also some expenses eligible for only partial deductions. These include:

- Client entertainment: Companies can claim a partial deduction of 50%.

- Interest expenditure: Companies can deduct up to 30% of the earnings before deducting interest, tax, depreciation, and amortisation, subject to a minimum threshold.

Understanding these taxation tiers and calculating the appropriate tax rate for your mainland company is essential for compliance and financial planning in the UAE’s evolving tax landscape.

Corporate Tax Filing for Mainland Companies

The process of corporate tax filing for mainland companies in the UAE depends on how businesses report their financial year.

Tax Calculation Period

The tax calculation period will vary based on the company’s chosen financial reporting date, as follows:

- Financial years beginning on July 1: Tax calculation and filing start from July 1, 2023.

- Financial years beginning on January 1: Tax calculation and filing start on January 1, 2024.

Tax Filing and Registering

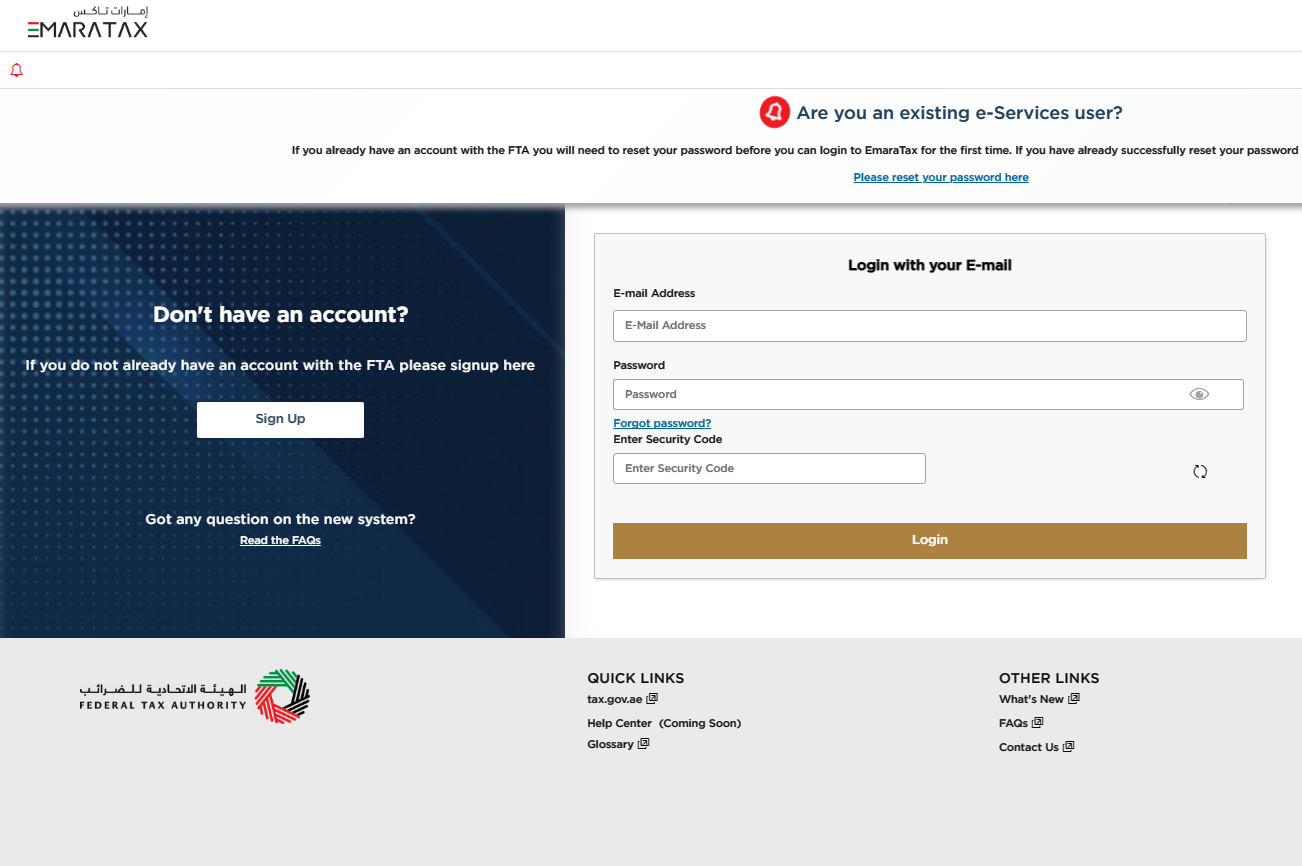

All commercial activities conducted within the UAE must register for corporate tax, mandated by the Federal Tax Authority (FTA). The straightforward registration process is available through FTA’s e-service portal, MARATAX.

Following the end of a financial year, companies have nine months to file their taxes and financial reports with the FTA – which accepts a range of reporting methods to simplify filing for businesses and professionals alike. Many medium and large companies in the UAE adhere to International Financial Reporting Standards (IFRS) to ensure compliance with international standards.

Source: FTA Website

Staying Ahead of the Competitors with Corporate Tax for Mainland Companies

It’s worth noting that the UAE’s 9% corporate tax rate is lower than many of its regional competitors, such as Saudi Arabia (20%), Oman (15%), Qatar (10%), and Bahrain (up to 46%). In comparison to other global economic regions, the UAE also boasts a more competitive rate than Gibraltar (10%), Ireland (12.5%), Hong Kong (8.5-16.5%), and Singapore (17%).

With this in mind, the introduction of the corporate tax regime is unlikely to diminish the competitiveness of businesses in the UAE. As long as companies stay informed, plan strategically, and prepare early, they can continue to thrive in this dynamic environment.

Final Thoughts on UAE Corporate Tax: Early Preparation is the Key to Remain Compliant

As we’ve explored the intricacies of the UAE’s new corporate tax landscape, one crucial takeaway emerges: early preparation is essential for ensuring compliance and remaining competitive in the global marketplace. While navigating this ever-changing terrain, minimising liabilities becomes a top priority.

As the UAE’s corporate tax landscape evolves, having a trusted partner is essential. Virtuzone offers comprehensive professional assistance with tax consultation, registration, and filing, ensuring your business stays compliant and competitive in this new era. In addition to tax-related services,

Virtuzone also specialises in business setup solutions, providing the necessary guidance and expertise to establish and grow your company in the UAE. Contact Virtuzone today and let our team of experts help you navigate the complexities of the UAE corporate tax regime confidently and efficiently.